Ethereum Price Prediction: Will ETH Hit $4,000 Amid Market Crossroads?

#ETH

ETH Price Prediction

Ethereum Technical Analysis: Key Indicators to Watch

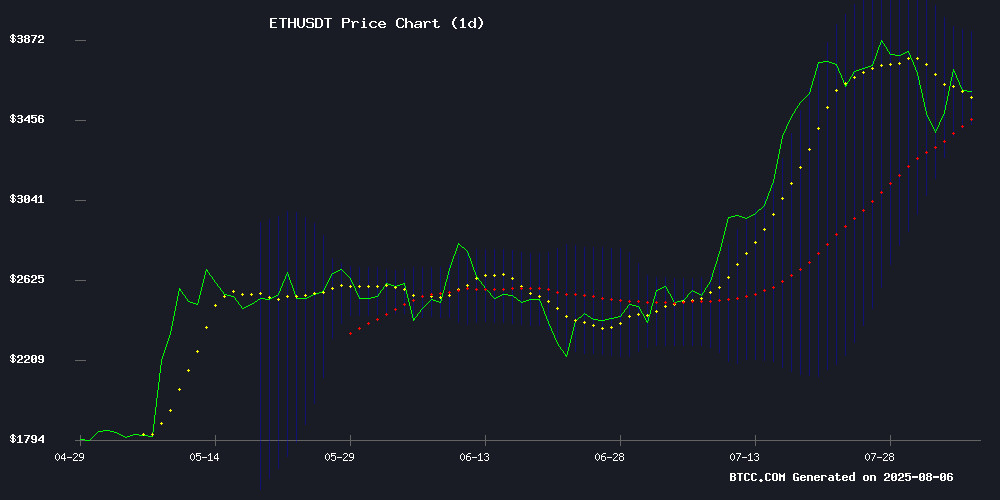

According to BTCC financial analyst Mia, ethereum (ETH) is currently trading at $3,622.08, below its 20-day moving average (MA) of $3,675.63. The MACD indicator shows a bearish crossover with values at -39.4358 (MACD line) and -218.7454 (signal line), but the histogram suggests some upward momentum at 179.3096. Bollinger Bands indicate potential volatility, with the upper band at $3,918.28, middle band at $3,675.63, and lower band at $3,432.99.

Ethereum Market Sentiment: Mixed Signals Amid Regulatory Clarity

BTCC financial analyst Mia highlights that Ethereum's market sentiment is mixed. On one hand, small-cap firms are accumulating ETH, with SharpLink nearing $2B in holdings. On the other hand, derivatives markets show weakness, and the price struggles above $3,700. Regulatory clarity from the SEC on liquid staking tokens could provide long-term support, but short-term price action remains uncertain.

Factors Influencing ETH’s Price

Small-Cap Firms Accumulate $3.5B in Ethereum as Staking Demand Grows

Ethereum is emerging as a preferred crypto hedge for institutional investors, with small-cap companies now holding $3.5 billion worth of ETH in treasuries. The token's staking yields and middle-ground volatility profile between Bitcoin and stablecoins are driving adoption.

Reuters reports these firms view ethereum as a less risky alternative to speculative tokens while offering better returns than traditional assets. "ETH provides active returns without extreme volatility," notes Anthony Georgiades of Innovating Capital. The trend reflects a broader pivot toward yield-generating crypto assets.

Fundstrat's Tom Lee joins growing institutional voices bullish on Ethereum's dual role as both a staking vehicle and growth asset. Exchange data shows concentrated ETH accumulation across Bybit, Binance, and Coinbase as treasury strategies evolve.

SharpLink Nears $2B in Ether Holdings, Targets 1M ETH Treasury

SharpLink, a former gaming firm, has amassed 521,939 ETH worth approximately $1.9 billion, marking a significant stride toward its goal of holding 1 million ETH. The company's ETH-per-share ratio has risen to 3.66, up 83% since initiating the strategy in early June. All holdings are staked, generating over $3.3 million in rewards.

Joe Lubin, commenting on Ethereum's decade of uptime, described it as a "mainstream moment" for the network. He emphasized the convergence of traditional finance and decentralized finance, predicting the distinction will soon dissolve. "Stablecoins and Ether treasury companies are bringing Wall Street onto DeFi so soon it’ll just be called 'finance,'" he said.

Despite its aggressive accumulation, SharpLink trails Bitmain Immersion Technologies, which holds 833,100 ETH. The race for ETH treasuries underscores institutional confidence in Ethereum's long-term value.

Ethereum Derivatives Market Signals Weakness With Lowest 2024 Trading Ratios

Ethereum's futures market is flashing warning signs as Binance data reveals a taker buy/sell ratio of 0.87—the lowest level recorded this year. This metric, falling below the critical 1.0 threshold, underscores dominant selling pressure in the derivatives market. Multiple attempts to breach the $4,000 resistance level have faltered, reflecting trader hesitancy at current valuations.

Analyst Darkfost notes the bearish trend took hold in mid-July, with sustained selling activity curtailing upward momentum. Technical indicators across multiple timeframes now reinforce the consolidation narrative. Yet some market participants maintain ambitious long-term targets between $8,000-$10,000, betting on Ethereum's fundamental strengths despite near-term headwinds.

Ethereum Price Falters Above $3,700 – Is a Pullback Brewing?

Ethereum's price action shows tentative recovery signs after finding support near $3,400, though resistance at $3,700 proves formidable. The second-largest cryptocurrency faces renewed selling pressure after failing to sustain momentum beyond the 61.8% Fibonacci retracement level of its recent downturn.

Technical indicators suggest a precarious balance between bulls and bears. The breach of a key bullish trendline at $3,620 on hourly charts signals weakening upside potential, with the 100-hour moving average now acting as dynamic resistance. Market participants watch the $3,500 support zone closely—a failure to hold could trigger another leg downward.

Notably, Ethereum's relative outperformance against bitcoin during this recovery attempt hints at lingering altcoin strength. The $3,750 region emerges as a critical battleground, where decisive breakout or rejection could determine the next directional move.

Ethereum Faces Crossroads as Analysts Debate Next Price Move

Ethereum's price action has entered a cautious phase, retreating 5% this week to hover NEAR $3,633 after failing to breach the psychologically significant $4,000 resistance level. The second-largest cryptocurrency now oscillates between $3,500 and $3,700 as market participants digest recent gains.

Binance derivatives data reveals mounting selling pressure, with the taker buy/sell ratio plunging to 0.87 - its lowest reading this year. This metric signals traders are either unwinding long positions or initiating shorts, creating headwinds for upward momentum. The trend emerged in mid-July and shows no signs of abating.

Darkfost, a CryptoQuant analyst, notes Ethereum's futures market dynamics have shifted markedly. 'The market's inability to conquer $4,000 despite multiple attempts speaks volumes,' the analyst observed. Such hesitation often precedes consolidation phases, particularly when occurring after sustained rallies.

SEC Exempts Liquid Staking Tokens from Securities Classification

The U.S. Securities and Exchange Commission has determined that certain liquid staking activities and their associated tokens do not constitute securities offerings. This decision, announced on August 5, 2025, provides much-needed regulatory clarity for decentralized finance platforms and staking protocols.

Staking Receipt Tokens, which represent staked digital assets, were evaluated under the Howey Test framework. The SEC concluded these tokens fail to meet the 'efforts of others' criterion, as their value derives directly from the underlying blockchain assets rather than third-party management.

The ruling eliminates registration requirements under both the Securities Act of 1933 and the Securities Exchange Act of 1934 for qualifying staking programs. Market participants view this as a watershed moment for cryptocurrency innovation, particularly for Ethereum-based staking derivatives and interoperable blockchain networks.

SEC Chair Paul Atkins Hails Liquid Staking Guidance as Regulatory Milestone

SEC Chair Paul Atkins has endorsed the agency's updated stance on liquid staking protocols, calling it a "significant step forward" in clarifying regulatory boundaries. The August 5 statement from the Division of Corporation Finance suggests certain staking activities may fall outside securities regulations.

"Under my leadership, the SEC is committed to providing clear guidance on emerging technologies," Atkins declared via Twitter. The announcement coincides with the rollout of Project Crypto, a new SEC initiative aimed at addressing digital asset oversight.

This development signals potential relief for Ethereum staking services and liquid staking derivatives, though the SEC maintains jurisdiction over other crypto activities. Market observers anticipate the guidance could accelerate institutional participation in proof-of-stake networks.

US SEC Clarifies Stance on Liquid Staking: Not a Security Under Specific Conditions

The U.S. Securities and Exchange Commission has provided much-needed clarity on liquid staking, ruling that it does not constitute a security under certain conditions. This decision removes a significant regulatory overhang for the cryptocurrency sector, particularly for proof-of-stake blockchains and decentralized finance protocols.

Market participants had awaited this guidance amid growing institutional interest in staking services. The SEC's position could accelerate adoption of liquid staking solutions while maintaining necessary investor protections. Ethereum and other proof-of-stake networks stand to benefit most from this regulatory development.

SEC Commissioner Advocates for Crypto Privacy Amid Tornado Cash Trial

Hester Peirce, a pro-crypto SEC commissioner, has publicly endorsed privacy-enhancing technologies like mixers and encrypted networks, despite the ongoing legal crackdown on Tornado Cash. Her remarks, delivered at UC Berkeley, underscore a growing divide within federal regulators over the role of privacy in digital assets.

The Tornado Cash trial has brought crypto privacy into sharp focus, with defense arguments highlighting conflicting regulatory priorities. Peirce's speech directly challenges the DOJ's stance, advocating for Americans' right to use privacy tools without government interference.

This internal regulatory conflict could influence future enforcement actions. The crypto community has taken note of Peirce's references to cypherpunk philosophy, seeing it as a potential shift in how regulators view financial privacy in blockchain ecosystems.

Will ETH Price Hit 4000?

BTCC financial analyst Mia suggests that while Ethereum faces short-term resistance near $3,700, the $4,000 target is achievable if bullish momentum returns. Key technical levels and regulatory developments will play a crucial role. Below is a summary of critical data:

| Indicator | Value |

|---|---|

| Current Price | $3,622.08 |

| 20-day MA | $3,675.63 |

| MACD Histogram | 179.3096 (bullish momentum) |

| Bollinger Upper Band | $3,918.28 |

- Ethereum is trading below its 20-day MA, indicating short-term bearish pressure.

- MACD shows a potential reversal signal, but confirmation is needed.

- Regulatory clarity on staking could boost long-term confidence.